For anyone using Intuit’s QuickBooks Online Payroll subscription, there are important updates that will require immediate action affecting W2 printing and tax impounding. Keep reading to learn more about these updates and what you need to do.

Intuit QuickBooks Payroll Update 1: W2 Printing

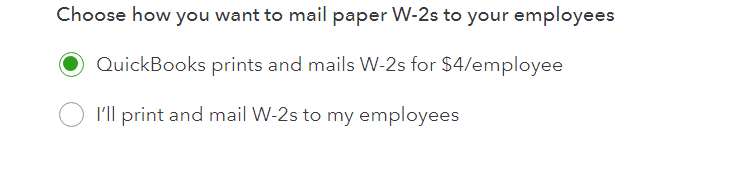

The first big change Intuit is implementing is starting January 2025, QuickBooks will automatically mail W2’s to your employees. You will be charged $4.00 per employee W2 sent.

Important Note: This change is automatic. If you do not want this additional service and incur the fee, you must change your W2 settings on or before January 3, 2025.

How to Change Your W2 Settings in QuickBooks

- Log into your Quick Books Online file

- Click the fear in the top right corner

- Select payroll settings

- Scroll down to the From W-2 Printing section

- Click the pencil on the right and make your selection

Intuit QuickBooks Payroll Update 2: Tax Impounding

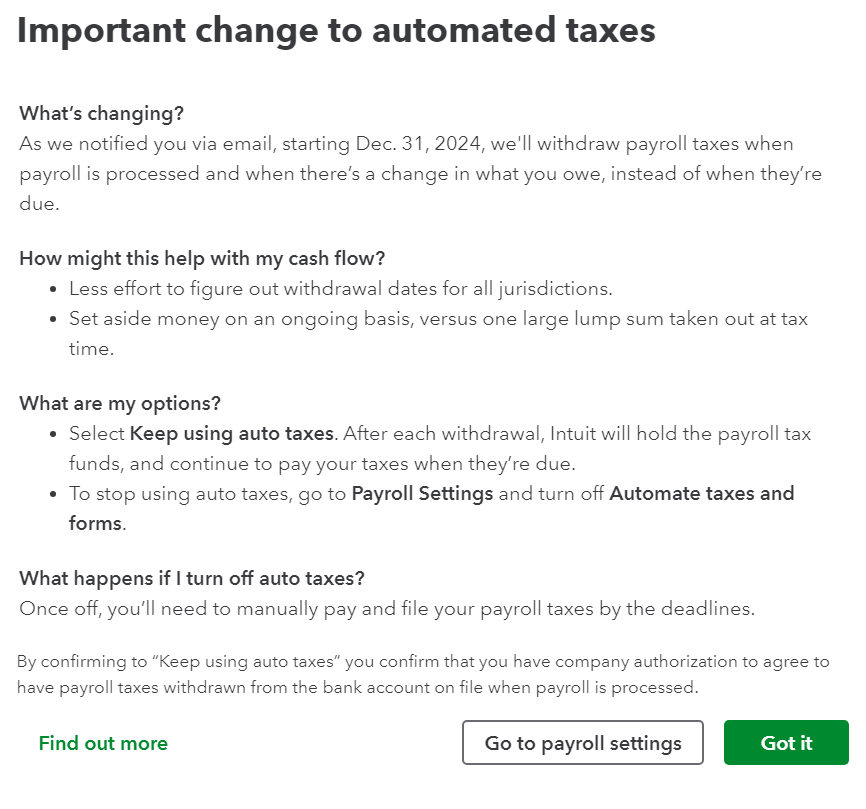

The second big update from Intuit is affecting the tax impound process for automatic payroll tax payments and payroll tax returns.

Beginning January 1, 2025, Intuit will begin impounding funds with each payroll regardless of the tax filing frequency.

All payroll clients must confirm within their QuickBooks Online file if they want to continue using this automatic payroll tax service.

Important Note: If you do not make this confirmation by December 31st, 2024, automatic taxes will be turned off and the employer will be responsible for scheduling and filing all tax payments and returns.

The following pop-up message should appear when you run your next payroll. Follow the prompts in the pop-up to verify you want to continue using automatic tax payments.

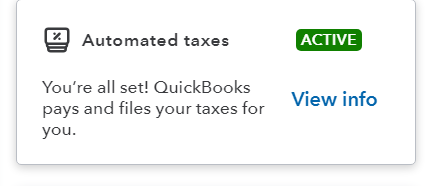

If you do not receive the pop-up window, the primary admin on the account must go to the Payroll Overview page and select “Keep using automated taxes.” Once selected the automated taxes window will show as active. Here’s an example of what you’ll see:

Need Intuit QuickBooks Payroll Help?

If you need help navigating the changes from Intuit, several of our team members are QuickBooks ProAdvisors who can help you along the way. Contact us to learn more about how we can help you with QuickBooks and all of your accounting needs.

If you’re a current MRPR client, your accountant will reach out to you to confirm your desired changes and answer any questions you may have.